Scope 3 Emissions: Why they are so Elusive?

Scope 3 Emissions are difficult!

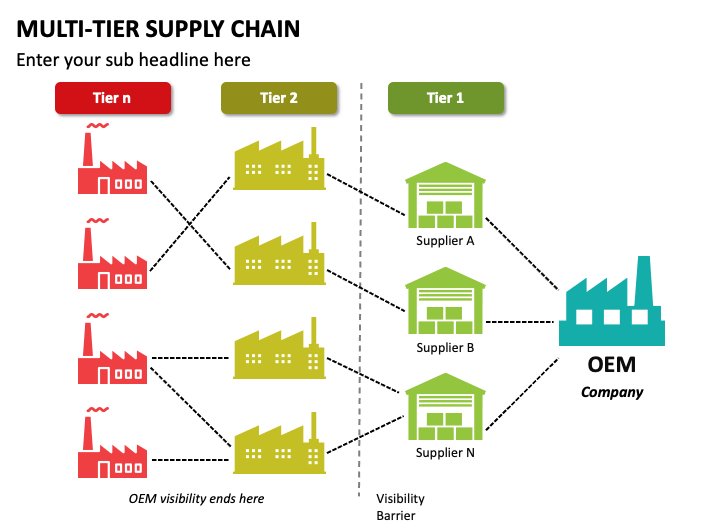

In fact, they are so difficult that most companies avoid them like the plague. instead opting for reporting Scope 1 and 2 emissions. Even within Scope 3 calculations, most firms would simply stop at calculating the emissions from Tier 1 suppliers.

But why is this the case? I suppose yes, it’s very difficult to get data from suppliers, and supply chains are incredibly complex. But aside from the practical, the theoretical concept of Scope 3 seems to be completely baffling to most.

Let’s look at the concept of Scope 3 to get a contextual understanding:

Scope 3 Emissions

Scope 3 Emissions usually refers to all the emissions that is produced from all of your suppliers that are “embodied” in the product you are making. If you sell steel, then your firm might produce some emissions from transport, building operations, energy usage. But also, there are emissions associated with the firms you bought the materials you made your product from. A gold refinery, in carbon accounting, responsible for the emissions the mining company generated by burning diesel on is Haul trucks to mine the ore. These are called Upstream-Operational-Embodied Emissions.

To calculate these Operational Emissions, we need to go to the Tier 1 suppliers (or the first suppliers away from the reference firm) and calculate their total operational emissions. But this doesn’t account for the whole process of producing the product. We now need to go back to the Tier 2 suppliers, then the Tier 3 suppliers, and so on.

We do this and get all the way back to the point where we know the emissions produced from digging the iron ore out of the ground in the mine site.

Embodied Capital Emissions

That gold ore was dug out of the ground by a machine. The machine was also facilitated by a building, factory, workforce etc.

What why don’t we calculate the embodied emissions generated from producing that those things? After all, they were also responsible for producing the steel. These types of embodied emissions are generally called Upstream Capital Emissions.

So now we go through the same thing. Tier 1, 2 and so on suppliers for the machine. And then the emissions of things that we responsible for producing that machine.

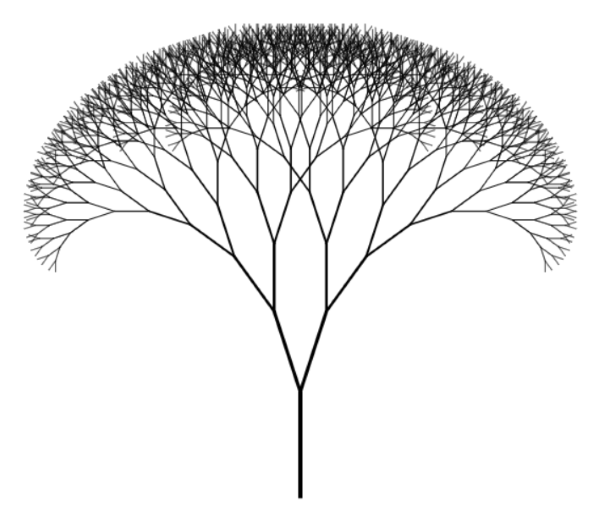

This results in a near infinite regress.

Not only that, but emissions will definitely be counted multiple times since supply chains crossover often. So, just by adding embedded emissions in the equation for Scope 3 emissions, we create a situation where the calculation becomes theoretically impossible.

But why don’t we just ignore these embedded operational emissions from peripheral suppliers?

The Importance of Embedded Emissions

Imagine we have a firm that is refining gold.

When this firm refines gold, it uses extremely efficient renewable energy processes involving batteries, solar panels, and electrical heating and melting. This is great, isn’t it? Wrong.

Whilst the operational emissions of the firm might be extremely low, the emissions that were used to produce those batteries, solar panels, machinery, hydrogen cells and such may be extremely large. When you think about it, you need to refine silicone, aluminum, tin, copper, metallurgical grade quartz and many more just to produce a solar panel. This has an associated emissions profile.1

Now when you take the whole firms’ operational emissions, and their embedded emissions and sum up all the emissions profiles, there might be a larger emissions profile than a simpler gold refinery using fossil fuels and coal in their operations.

Determining Embodied Emissions Profiles

At this point, many would ask: How do you determine these emissions profiles? As I’ve demonstrated, if you don’t have clear boundary conditions, your problem diverges into an exponential fractal that just accounts for the entire system. But I would like to propose a solution to this.

This solution involves defining boundary conditions, however not arbitrarily. Where do we stop the analysis?

We will assume that the emissions of a firm, is the difference between having the firm, and replacing the firm with a more traditional alternative.

Why? Because the reason we want to know Scope 3 emissions in the first place is to have a metric of which to determine whether a firms CO2e emissions are better, or worse for the environment compared to what we usually have.

But how do we do this?

We must compare the emissions of the system with the firm, with the emissions of the system without the firm.

I’ve done the mental work of trying to understand how this can be done, and how to determine this. I’ve put together some boundary conditions that can help with producing the result we want.

Boundary Conditions

Reference Capital Embodied Carbon:

If a supplier wouldn’t exist without the demand from the reference firm, then we include them as a part of the reference firm (append onto the reference firms Capital emissions).

Firms that supplied the Materials to build the Reference Firm i.e., buildings, factories etc. are included as Capital suppliers.

The Capital Emissions equals the Operational emissions of the firms producing its materials, times by the share of production of those firms (what percentage of the total emissions was generated by the product).

Another idea in our functional analysis, is that we need to consider that the emissions accounting is meant to provide data for things so that we can control better outcomes in the future. If we continue to go back in an infinite regress, before human activity on the product (i.e., how much CO2e was being generated from natural forces on the iron ore etc.), then we calculate things about the product that don’t really matter.

In essence, what I mean is that we shouldn’t be calculating emissions for processes that we can’t control. This depends on the circumstances of the analysis. What impact are we trying to make with this data? If we are presenting this report to investors, then we include the emissions that they can control. It depends on the intended audience. The same if we are presenting to a government body. But we need to stop the analysis of material operational emissions here. 2

Reference Product Embodied Carbon:

If a supplier would exist without the demand from the reference firm, only account for the embodied emissions of the reference material.

The embodied emissions of the reference materials equal the operational emissions of all suppliers in the chain being analyzed, times the percentage share of production.

Calculate the embodied emissions like this from the life cycle of the product. Include any loops in supply chains, up until it ends up in our reference firm. (If a product loops twice, you add the operational emissions of the product going through each firm in the loop twice).

Calculation Example

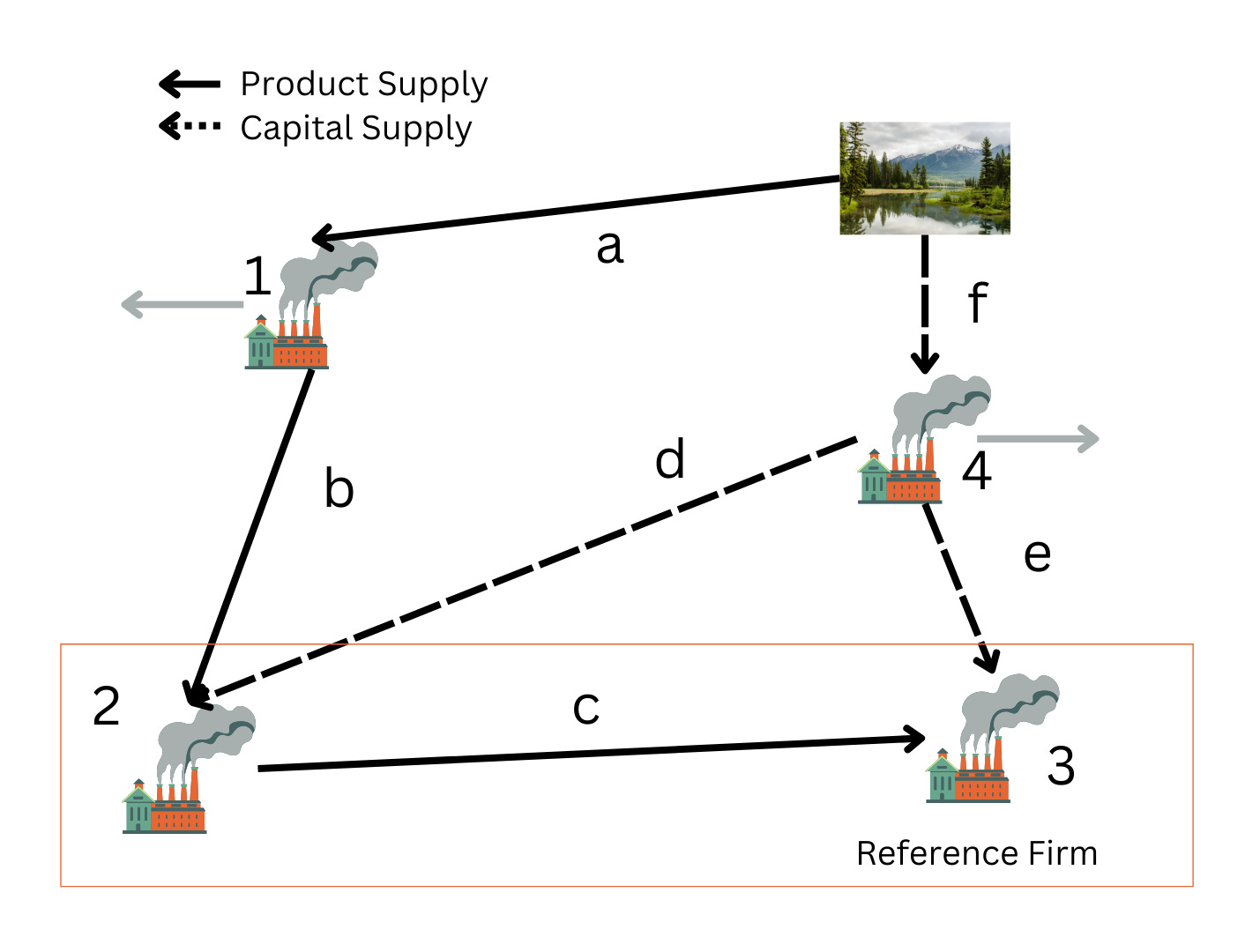

In the example above, we can see a fairly simple supply network. I’ve labelled the firms with numbers from 1 to 4. The flows of material, also representing their associated operational emissions between the firms are labelled from a to f - these are variables that would represent the percentage of material that firm is outputting to the firm. E.g., from 2 to 3, we assume that the output of 2 is 100% (or 1) into firm 3. These letters (a to f) will represent a proxy for an emissions factor.

The dotted lines represent material flowing to make the Capital Component, i.e., the factories, machines and such to facilitate production. The solid lines represent the material flowing to make the actual product i.e., the iron ore to eventually turn into steel.

Coupling Capital Emissions

The first thing in our analysis is to identify the firms that would not exist without the reference firm. We can clearly see that Firm 2 solely exists to produce for our reference firm since it has 100% of its output. On the other hand, we can see that Firm 1, and Firm 4 produce for other firms. We will assume that 1 and 4 have other suppliers that they produce for and are not dependent on our reference firm.

Now that we have identified our dependent firm, we can group them together using the red box.

Calculating Upstream-Capital-Embodied Emissions

Because our dependent firm is in the red box, we will include it in calculating the Upstream Capital Emissions.

C = Total Capital Emissions

M = Total Material Emissions

O(x) = Operational Emissions of x

E(x) = Embodied Emissions of x

S3E = Total Scope 3 EmissionsIn the end, we get the equation:

Conclusions

You can apply these types of analytical boundary conditions to all carbon accounting procedures involving Scope 3 Emissions. I won’t go as far to say that it is perfect, however. As mentioned, it is difficult to set these boundary conditions in a numerical manner, often a qualitative assessment would be required. Similarly, supply chains and networks in the real world, are often too complex to get the required operational data, and we will need to do some simplifying, and use of spurious proxy measurements to get what we want.

Despite this, I think the ideal concept of what Scope 3 is supposed to be doing is illuminated a bit more in this article.

Since this is all autodidactic on my part, I would love to hear from actual carbon accountants and green professionals on this.

There is something to be said about having an all electrified future. In a sense, having a fully autopoietic fleet of machines that can make themselves. This, in my current view, depends greatly on the EROI of the energy harvesting technology.

There will need to be some kind of objective or proxy metric that we can use to decide the degrees of “control” that the audience has over certain firms. Perhaps a qualitative assessment is fine, but that leads to subjectivity.